Fintechzoom Ford Stock: EV Growth & Market Analysis

Ford has been making cars for over 100 years in America. It is one of the biggest car companies in the world. How well Ford’s stock does can tell us how healthy the company is financially and how good its cars are.

Lately, Ford’s stock price has gone up and down. This is because of big changes happening, like electric cars and self-driving cars. To understand what is helping or hurting Ford, you need information you can trust.

Fintechzoom Ford Stock

This article will look at important things that could affect Fintechzoom Ford Stock in the next year. The goal is to give investors good facts to make smart choices about buying or selling Ford stock.

Why Fintechzoom for Ford Stock Analysis is Crucial

Investors need insightful information to seize stock market opportunities. Fintechzoom empowers investors with vital data and perspectives on stocks like Ford.

Key advantages of using Fintechzoom for Ford stock analysis:

- Real-Time Updates: Access the latest Ford stock prices, charts, financial metrics, and news to respond swiftly.

- Actionable Analysis: Expert commentary provides perspectives on Ford’s valuation and growth drivers. It also covers competitive forces and technology plays.

- Predictive Modeling: AI forecasting gives future insights into Ford’s stock path.

- Peer Benchmarking: Compare Ford with automotive peers on vital performance indicators to gauge strengths and weaknesses.

Fintechzoom levels the playing field for retail investors. It provides authoritative, trustworthy intelligence on stocks like Ford.

How Ford is Performing Now and What’s Impacting it

Ford’s business has been going through ups and downs lately. Let’s look at some key factors that give us signals on how Ford is doing.

Financial Numbers

Ford reported its first quarter 2025 results recently. The numbers showed some positives for the company:

- Revenue was higher than last year as Ford sold more higher-priced trucks and SUVs. This improved overall profit margins.

- Cost inflation remains a concern. However, Ford has enough cash reserves and borrowing ability to manage through challenging times.

- Profits were better than expected. Ford’s CEO said the company is on track to meet guidance for the full year.

This table shows Fintechzoom Ford Stock opening and closing prices for each month in the last six months of 2025.

| Month/Day | Open Price (USD) | Close Price (USD) |

| October 21, 2024 | 11.08 | 10.98 |

| October 20, 2024 | 11.15 | 11.19 |

| October 19, 2024 | 11.08 | 10.98 |

| October | 11.08 | 10.98 |

| September | 10.68 | 10.8 |

| August | 10.56 | 10.14 |

| July | 12.13 | 10.69 |

| June | 12.1 | 10.31 |

| May | 12.39 | 12.11 |

New and Improved Products

Ford has launched electric versions of its popular F-150 pickup truck and Mustang car. The F-150 Lightning and Mustang Mach-E are their names. This shows Ford working to make greener cars that customers want and that follow rules set by the government.

Ford is also putting money into features that could help drive its business in the future. Things like self-driving cars and internet-connected cars. This aims to help Ford grow its sales as technology advances.

The Broader Economy’s Impact

Some wider economic developments can positively or negatively impact Ford’s performance:

- Rising interest rates make auto loans more expensive. Inflation also makes vehicles less affordable. This may slow sales.

- Job growth and higher wages support the demand for new cars and trucks. Also, vehicle inventory levels are recovering after shortages during pandemic shutdowns.

- Issues like the Russia-Ukraine war add uncertainty and affect gas prices, raw material costs, and supply chains. This causes difficulties for automakers.

Auto Market Competition

The auto industry is seeing intensifying rivalry. New electric vehicle models from traditional and startup companies will compete with Ford’s offerings.

However, Ford has loyal truck buyers in the US and a broad dealer network. As people resume delayed purchases, demand is expected to rise after slumping during the pandemic – though the rebound may lose some steam.

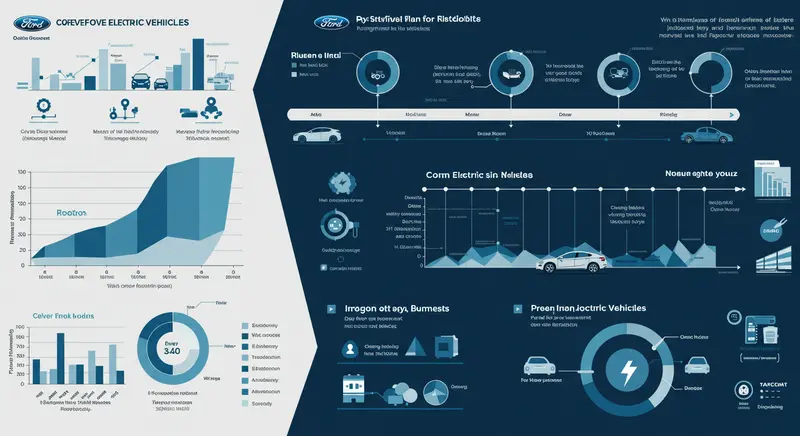

Ford’s Plan for Electric Vehicles

Ford is making a major push into electric vehicles (EVs) and investing billions of dollars.

Iconic Model Launches

An Icon Goes Electric The newly launched electric F-150 Lightning pickup truck is a showcase of Ford’s EV ambitions. The F-Series pickup has been America’s top-selling vehicle for 40 years running. Taking this icon into the EV era with the Lightning carries huge symbolic value. If this model sells well, it would signal that EVs are now mainstream and could disrupt the auto market.

Market Growth Potential

Beyond the Lightning, Ford is growing its portfolio of electric models:

- The Mustang Mach-E is an electric SUV with sporty styling that appeals to fans of Ford’s legendary Mustang muscle car.

- The E-Transit is Ford’s first electric van, aimed at commercial delivery businesses seeking fuel savings.

Government incentives make EVs cheaper to buy. These factors, along with rising gas prices and climate change concerns, will boost EV demand. New regulations are also pushing automakers to sell more electric models over time. Expanding charging stations nationwide further enables adoption.

Ford’s diverse EV lineup positions it well to build market share. Consumer interest and regulatory pressures are accelerating the transition from gasoline vehicles.

Autonomous Driving Advancements

Ford is working with a company called Argo AI to develop self-driving cars. Argo’s self-driving vehicle, called the Driver, is set to be available for commercial use by late 2025. There are still questions around rules from the government and people trusting self-driving cars.

However, Ford plans to offer self-driving transportation services in the future. This could significantly boost its money-making potential in the long run. This opportunity is valuable for Ford even though developing self-driving technology costs a lot of money now. Self-driving services may help Ford earn more revenue and profits over time if all goes well.

Impact of Fintech

Fintech is empowering Ford’s finance verticals, including consumer lending and credit services. Digital and mobile innovations are also enhancing sales channels and customer engagement. Ford is also using financial technology, called fintech, across its business.

Fintech helps Ford analyze its supply chain better and improve how it makes cars. It also helps Ford manage its employees. All of this aims to make Ford more productive and efficient.

Fintech adoption is providing real advantages for Ford’s costs. As Ford saves money in different areas, it can improve its financial performance. Stronger finances are good for Ford’s stock price over the long run. So, fintech is an important part of Ford achieving upside for shareholders.

Competitive Analysis

By comparing products, efficiency, and new technologies with competitors, we can analyze Ford’s position. This helps us understand the competitive analysis of Fintechzoom Ford stock

Automaker Competition

The car industry is changing fast. Other big companies like GM and Toyota want to be the top maker of electric vehicles. This puts pressure on Ford to keep improving its cars and new technologies. American truck owners may start preferring other brands too. Selling cars could get harder for Ford in its important US market.

Startup Competition

New companies like Rivian and Lucid are gaining popularity with customers and investors, especially for electric vehicles. Their specialized models and digital focus make them serious threats in the future. However, startups may struggle when they need to mass-produce vehicles. Ford has an advantage with its experience in making cars on a large scale.

Risk Factors

Market uncertainties and risk factors can also affect Fintechzoom Ford stock values. Here are some factors and market situations to consider before investing in Ford.

Industry Challenges

The car industry faces challenges like:

- Problems making vehicles

- Higher costs for materials

- Shortage of skilled workers

- Rising loan rates

While the economy is still doing okay, a slowdown could seriously decrease demand for cars. Ford’s sales are strongly tied to the overall economy.

Market Uncertainties

Investor confidence in car companies has been up and down. This is due to worries over slowing sales, thinner profits, and high-growth companies losing value. Any bad news from Ford about its products or finances could further damage the already shaky belief on Wall Street. Ford has little room for mistakes.

Strategic Restructuring

Businesses everywhere are always changing to keep up with the market and beat the competition. They often restructure to improve operations, simplify processes, and focus resources on growth.

Streamlining Operations

Ford is optimizing these operations:

- Closing unprofitable overseas plants

- Reallocating capital to growth domains

- Targeting $3B in cuts through 2026.

This structural optimization aims to improve resilience against market fluctuations. However, restructuring expenses can create short-term earnings drags.

Investing in Future Technologies

Big investments in EVs, batteries, and connectivity are crucial for Ford to stay competitive. These investments increase cost pressures. However, focusing on technology makes Ford more attractive to growth and ESG investors. This is a good sign.

Expert Predictions and Forecasts

Predictions and forecasts are key in many areas, from weather forecasting to stock market predictions. Experts make educated guesses about the future using past data and trends.

Global Vehicle Electrification Trends

Industry analysts highlight durable EV tailwinds as crucial to Ford’s growth equation. Consensus expectations predict electric vehicles will make up over 65% of total auto sales by 2040. This growth is supported by falling battery prices and a wider range of models. Ford’s moves align with this overriding trend.

Autonomous Driving Advancements

Experts predict fully autonomous vehicles will be viable by mid-decade. This could open up a market opportunity worth an estimated $7 trillion. Ford’s early start with Argo AI could be a big advantage if managed wisely. But regulatory unknowns persist.

Conclusion

Ford’s results from the first part of 2022 were positive as changes to its vehicle lineup did well, and Ford was able to charge more. However, car sales may soon reach their highest point in the cycle. Competition in trucks and electric vehicles is also expected to grow tougher.

Whether Ford’s success continues depends on how steady demand remains. It also depends on Ford’s ability to achieve its goals in electric vehicles and self-driving cars.

Fintechzoom helps investors with the latest Ford data, clear explanations, and stock predictions. This information aims to allow investors to make smart choices about Ford.